In this series of articles, we dive deep into our Solutions fund, shedding light on its history, methodology, and active ownership strategies that back up the investment work. This first piece by Philip Ripman, Portfolio Manager and the Head of the Solutions teams, offers a glimpse into the history and purpose of Solutions, and highlights important findings from white papers, which will be launched later this autumn.

The Sustainable Development Goals were unveiled in 2012, during the United Nations Conference on Sustainable Development in Rio de Janeiro. Designed to replace the Millennium Development Goals, this framework sought to identify a set of universally applicable goals to address the urgent environmental and social issues of our times. Our pressing challenges were divided into 17 goals and 169 targets to allow effective response.

The idea behind SDGs was to create measurable universal objectives for achieving sustainable development while balancing social progress, economic growth, and environmental protection. The goals were to be reached by 2030.

The launching of the SDGs inspired us to evolve our Solutions funds in a way that would contribute to the achievement of these goals by placing capital in the right place. From 2016 to 2018, we transitioned the Solutions fund to match certain SDG themes, ones which we recognised as the most pressing challenges for a just transition to a green future.

Going back to the right questions

Of course, having worked in sustainable investment since 2006, I can say that Solutions as an SDG-themed fund was born both from a feeling of frustration and a recognition of missed opportunities. I was feeling something was amiss in how we approached sustainability in our sector: we were focused way too heavily on the how when we should have started with the what.

How a product or service is produced is absolutely relevant, but the order of importance and sequence was and still is largely backwards. In the world of sustainable investing, the entry point to evaluating an investment in the public equity market needs to be the what, the product and/or service the company generates. If the product and/or service is not aligned, does not have a positive impact and cannot be said to contribute to solving the Sustainable Development Goals, then considering how the product and/or service is made is largely irrelevant for consideration on whether the company contributes to solving the SDGs. However, sequentially, once the product can be said to have the desired properties, how the product is made is more relevant when considering peers and their relative performance.

In team Solutions, we prioritise the question of what: What is the contribution of this company to the attainment of transition, through its products or services? A product or service that contributes to the attainment of SDGs, by ensuring more equal access to healthcare or by cutting emissions of energy production, takes center stage in our investment planning. Without a promising product or service, considering how the product and/or service is made is largely irrelevant for consideration on whether the company contributes to solving the SDGs.

This is not to say that we tolerate worst-performers of sustainability: Once we decide on a product or service that fulfills our initial requirement of contributing to SDGs, the how becomes more relevant when considering peers and their relative performance.

Long way to go in attaining SDGs

For the past seven years, we have been doing our best to contribute to the attainment of SDGs by allocating financial resources to companies that offer solutions to these problems. Yet, we still have a long way to go.

We are merely seven years away from "finishing what we started with MDGs," but we are far from achieving most SDG targets, with limited progress or even regression in some. Even though we are currently in the Decade of Action, called by the UN Secretary-General and urging different sectors to collaborate in the achievement of SDGs, the progress on SDGs seems underwhelming.

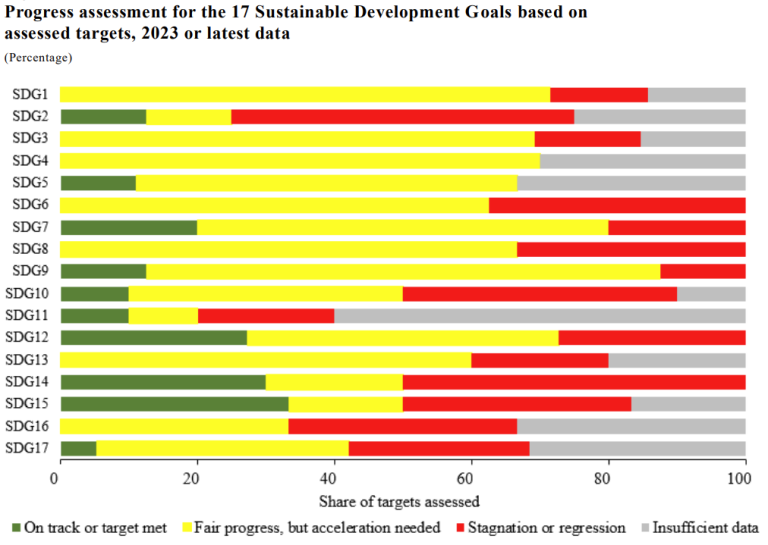

As you can see in the graph below, there is virtually no significant progress towards attainment for some of the most important SDGs like #1 no poverty, #3 good health and well-being, #4 quality education, #6 clean water and sanitation, #8 decent work and economic growth, #13 climate action, and #16 peace, justice and strong institutions.

When there is development towards attainment, it is overwhelmed by stagnation in the SDG targets or an increasing need for acceleration to reach targets. There is no need to sugarcoat this – it is a grim picture on our path to 2030, the initial date to meet all of these targets.

Nonetheless, this situation should not push us towards inaction. We should find the inspiration and determination to pick up our pace in working towards SDG targets.

Lack of data poses its own challenges … and opportunities

While the proliferation and deepening of regulations help improve sustainability data related to companies and products and attempt to bridge the data gap, sustainability reporting is still an area full of gaps and inconsistencies.

This is not an area devoid of challenges. While regulation should help improve sustainability data related to products, it is an area full of gaps and lacking consistency even where there is an attempt to bridge the data gap. However, one could perhaps characterise this as both a risk and an opportunity. The lack of data could at least be said to contribute to avoiding a scenario where a potential opportunity is fully priced into the market, while on the other hand there is an increased level of risk in getting the investment thesis and theory of change correct. This is why having a diverse team with complementary backgrounds becomes so vital in understanding the interrelational aspects connected to companies, their products and sustainability.

Light at the end of the tunnel

Despite the lack of momentum in solving many of the challenges connected to sustainability, I still believe that the future is bright. There is an abundance of new business models being created that wish to harness the opportunity that sustainability represents. Time will tell how resilient and successful they are – and we need to make room for those that are succeeding in our portfolios.

In the meantime, we do not just wait for the right companies to show up at our door. We follow the latest research to complement our SDG-oriented portfolio construction and management. An important product of this review work is our white paper series, detailing developments in the realm of our fund themes, i.e., renewable energy, circular economy, equal opportunities, and smart cities.

Coming out fresh—Whitepapers 2023

First created in 2020, the whitepapers showcase our modular approach towards SDGs, and back up our practical work with the latest data and evidence.

However, we also recognise that the world does not look like what it used to be in 2020. For this reason, this summer, we recruited the help of our interns Marie Eskeland Børtveit and Christoffer Platou Bjørnsen to build on the work of the initial authors of these papers, our portfolio managers Ellen Andersen and Sunniva Bratt Slette. With further help from Nader Hakimi Fard, our latest addition to the portfolio manager team, these new versions take stock of our path to achieving SDGs, present the newest updates from sectors, and point out potential pathways for the future.

We hope to release the new editions during this autumn. In each paper, we have tried to trace the current trajectory towards the attainment of relevant SDGs, take stock of the regulation that supports these trajectories, and identify promising investment trends towards 2030 or 2050. More specifically:

- In Renewable Energy, we argue that even though there have been some positive developments in transitioning to clean energy, we need a significant shift in investments to achieve net-zero emissions by 2050. It is not enough to produce clean energy; we also need to address issues of energy storage and distribution.

- Smart Cities paper showcases that urban habitats are the arena for our most pressing sustainable development problems, but they also hold the solutions to these problems, if we can radically shift how we envision and plan our cities. Companies with the right technologies can address issues of water management, transportation, housing, and heating in urban habitats.

- Circular Economy represents the missing link that completes our sustainability trajectory by minimising waste and contributing to recycling, recirculating, and even regenerating our resources. Food systems and agriculture are one of the targets for circular economy companies, with opportunities in energy and chemicals sectors.

- Finally, in Equal Opportunities we put a special focus on equality in accessing essential services, like health, digital, and financial services. Examples include cybersecurity for vulnerable populations and widespread access to maternal and neonatal health. We cannot say we have achieved sustainable development when vulnerable populations are systematically excluded from equitable access to services improving their living standards.

As capital itself transitions to new owners, newer generations have access to more data, more science and more options than ever before. This capital is moving to align itself with purpose – and the purpose is wanting a world where the capital is still useful.