We have newly completed our latest annual round of screening our investment portfolios for deforestation risk, as of the end of April 2025. As expected, the overall results show little change in our exposure, compared to the analysis we conducted last year.

While the methodology for the analysis has remained the same, the degree of reliability of the analysis is now slightly better, as this year our data partner Forest IQ has increased the number of companies and made some improvements to the underlying data.

Focused on exposure to commodity-driven deforestation

Forests are critical ecosystems for the planet’s climate and biodiversity. They play a vital role in maintaining the global carbon cycle, acting as carbon sinks, capturing and storing carbon dioxide. Forests may also contain up to 80 per cent of terrestrial species (WWF, 2023), and provide a range of other ecosystem services, including regulation of the water cycle.

Identifying operations with potential negative impacts on forest ecosystems is a priority for us. However, there is limited data available that links listed companies to deforestation and forest degradation in specific locations. As most tropical deforestation is driven by production of soft commodities like beef, palm oil, soy, timber, pulp and paper, rubber, coffee and cocoa, our approach has been to assess investee companies’ exposure to these commodities through their operations, supply chains or financial relationships.

Using the Forest IQ dataset

To assess and disclose exposure to deforestation risks, we use the Forest IQ data platform, a comprehensive resource developed by Global Canopy, Stockholm Environment Institute and Zoological Society of London.

The Forest IQ data platform contains information on more than 2000 companies’ exposure to commodity-driven deforestation and their efforts to eliminate deforestation, conversion and associated human rights violations from their operations, supply chains and financial relationships. It includes data from the following datasets: CDP, Deforestation Action Tracker, Forest 500, SEI York, Trase, ZSL SPOTT and RSPO.

The forest risk commodities currently covered in the Forest IQ dataset are:

-

palm oil

-

soy

-

beef

-

leather

-

timber

-

pulp & paper

-

natural rubber

-

cocoa

-

coffee

-

gold

-

coal

While the coverage in number of companies and commodities is expected to continue to grow, Forest IQ already covers the majority of companies and financial institutions in our investment universe with material exposure to risks arising from commodity-driven deforestation.

Based on Forest IQ, we have utilized several metrics to assess our deforestation exposure.

How exposed are we overall?

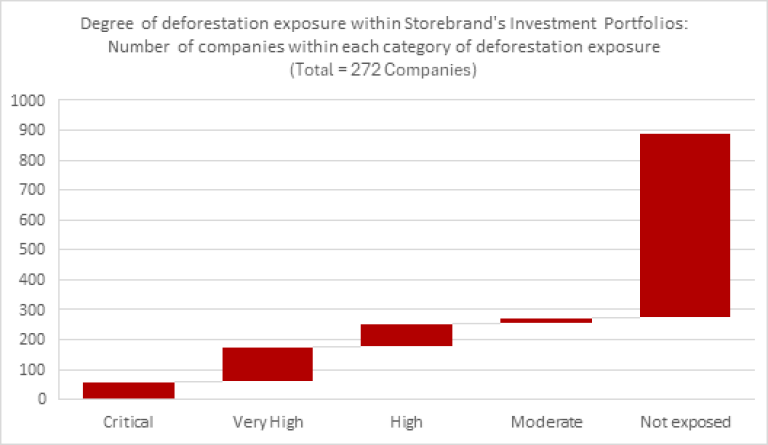

Metric 1: Number of companies in Storebrand's portfolios within each category of deforestation exposure

This metric assesses the level of exposure of our portfolio to companies potentially exposed to deforestation risk. Forest IQ places companies in different exposure categories, by estimating volume of commodities sourced or produced with potential risk of deforestation. (Financial institutions are assessed by estimating the amount of finance provided to companies with potential exposure to deforestation.) We track the number of companies, value of holdings, and percentage share of our total equity and bond investments held in companies that fall in the categories with the following exposure levels:

-

Critical

-

Very High

-

High

-

Moderate

In total, Storebrand has identified investments in 889 companies covered by Forest IQ, of which 272 are in the categories considered to be of material risk. Our holdings in these 272 companies represent 13.2 per cent of our total assets invested in equity and corporate bonds. Our exposure is predominantly through downstream companies, such as food processors, retailers or financial institutions, which are exposed through their value chains or financial relationships rather than their direct operations.

What sectors make up most of our exposure?

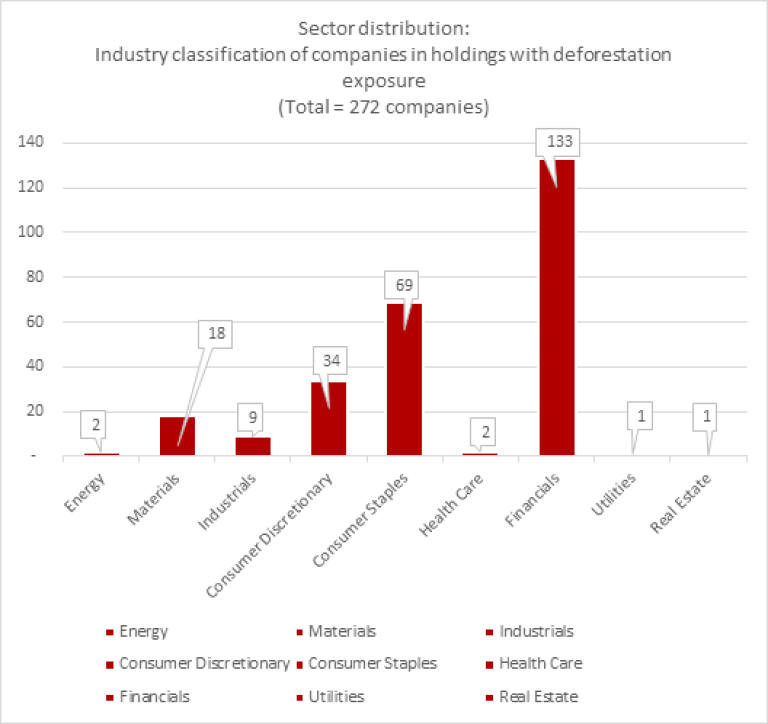

Metric 2: Sector distribution: Industry classification of companies in holdings with deforestation exposure

This metric analyses the distribution of companies identified under Metric 1, across various Global Industry Classification Standard (GICS) sectors, to identify which sectors in our portfolio are most exposed to deforestation risks.

By far, our largest exposure is to companies in the financial sector, such as banks, insurance companies and asset managers. This sector may be linked to deforestation risk through the companies they provide loans or other financial services to.

As the measures that companies in the financial sector can take to reduce risks arising from deforestation are very different from other sectors, investor engagement should be tailored specifically to the sector. For that reason, Storebrand contributed to developing a set of investor expectations for commercial and investment banks on deforestation, which were published by the Institutional Investor Group on Climate Change (IIGCC) and Finance Sector Deforestation Action (FSDA) in September 2024.

How do investee companies manage their deforestation risk?

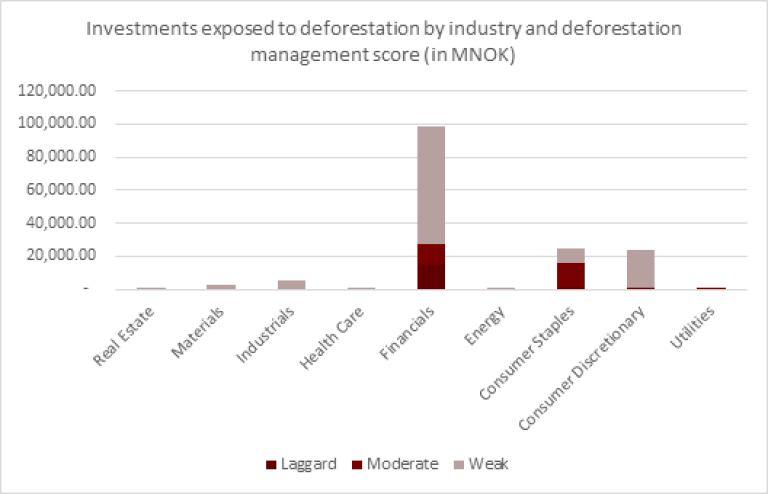

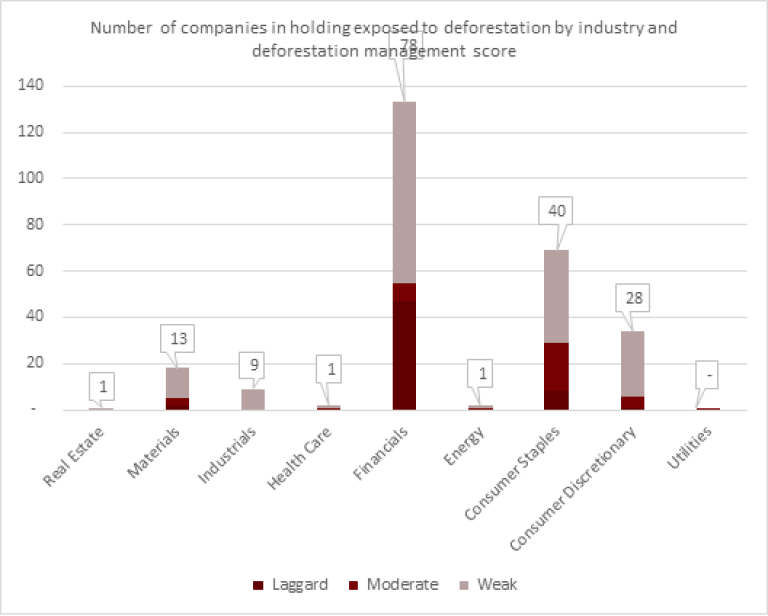

Metric 3:

Investments exposed to deforestation by industry and deforestation management score (in MNOK)

Number of companies in holding exposed to deforestation by industry and deforestation management score

Metric 3 evaluates how well companies manage deforestation risks, categorizing them into five performance tiers:

-

Laggard

-

Weak

-

Moderate

-

Advanced

-

Leader

The categorization of category each company, is done by assessing the quality of their commitments, actions taken and progress reporting, according to a detailed set of criteria developed by Forest IQ.

For companies identified under Metric 1 as being exposed to risk, we disclose the number of companies and value of holdings distributed across these performance categories. This metric provides insights into the effectiveness of companies’ deforestation risk management practices, which helps inform our stewardship efforts.

Assessment reflects the wide gap to desired performance

It should be noted that Forest IQ is a demanding standard, as shown by the fact that no companies in our portfolio score better than “moderate” – not even the companies that are widely recognized as best performers in their sectors.

To get a good understanding of companies’ progress towards ending deforestation, it is better to compare their performance to the standard needed to fully eliminate deforestation risk, rather than compare them to the mean performance of companies.

The numbers show that the largest share of “laggard” companies in our portfolio is in the financial sector, including commercial and investment banks. This is expected, as the financial sector lags behind other sectors in adopting policies and commitments regarding deforestation. In order to drive progress in the sector, Storebrand is engaging several large banks through collaborative initiative Finance Sector Deforestation Action (FSDA) and has contributed to develop best practice expectations for banks on deforestation.

What happens now?

Our Deforestation Policy from 2019 has the ambition of eliminating commodity-driven deforestation from our portfolios by the end of 2025. The policy includes four main lines of action:

-

Assessment and disclosure of exposure to deforestation risk

-

Company engagement and voting

-

Engagement with policy-makers

-

Exclusion of companies directly involved in deforestation (if engagement fails)

While we have achieved our internal activity targets for assessments, disclosure and engagements, it is clear that the world is not on track to meet the target of halting deforestation. To achieve that target, we need increased efforts from global society as a whole, including governments at all levels, businesses, investors, banks, civil society and local communities. That’s why it’s so important that the Global Stocktake (GST) positioned deforestation at the heart of climate action with the goal to halt and reverse deforestation by 2030.

Hundreds of companies are indirectly tied to deforestation risk through their supply chains ̶ or loan books in the case of banks ̶ and current data availability makes it impossible for investors to be 100 per cent certain that any of them are deforestation-free. Far too few investors have deforestation high on their agenda, and we need to make the issue more mainstream. At Storebrand we will continue to engage forcefully on the issue, beyond the initial target date of 2025, building on our experiences and dialogues since 2019. Today we have better understanding of company exposure; performance; and challenges; while companies now have a better understanding of our expectations.

The analysis we have presented here is used to inform our active ownership, including engaging with companies and voting at shareholder meetings. For example, we have identified 13 companies with “laggard” scores from Forest IQ, and communicated to the companies that we will vote against selected directors and/or financial statements if they do not improve their management of deforestation risk. We also support shareholder proposals asking for action against deforestation.

We continue to engage with companies in our portfolio that are involved in production, trade, use, or financing, of forest-risk soft commodities as well as mining. Our primary path for doing this is through the Finance Sector Deforestation Action (FSDA) initiative, gathering more than 30 financial institutions that have committed to using best efforts to end commodity-driven deforestation in their investment and lending portfolios.

In addition, we will continue to engage with policymakers in selected countries on deforestation, mainly through the collaborative initiative Investor Policy Dialogue on Deforestation (IPDD) where Storebrand is in the role of co-chair. Through our participation in the Institutional Investor Group on Climate Change (IIGCC), we are working to attract more investors to take action on deforestation, such as by including deforestation into guidance for climate and nature transition plans.