(1) State level tailwinds and energy independence supports further growth

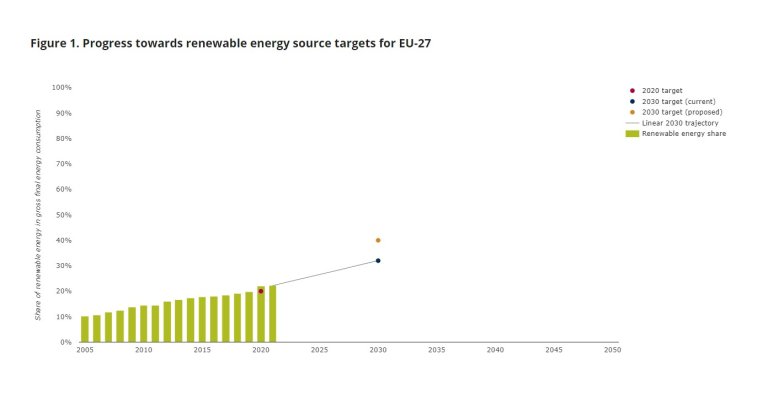

While the renewable segment continues to be volatile, it is important to note that state level conditions continue to add tailwinds. At the very end of March, the EU reached a provisional deal on higher renewable energy targets. The previous target was 32% renewable energy share, where an increase to 42.5% is now on the table. Though this is feasible, it would require an higher pace of deployment than we have seen previously.

We should also note that there are additional benefits, such reducing air pollution and improving energy security. The latter will certainly be more in focus as countries wrestle with decisions within OPEC to benefit its member states.

The motivations behind state level support for renewables have multiple dimensions. Yes, clearly mitigating climate change is one such motivation. However, the war in Ukraine, the role of OPEC and governments dealing with the effects of inflation while wanting to be reelected, all lend support to the fact that renewables could - to some extent - provide a level of independence that has previously been unattainable.

(2) Focus on removing permitting barriers

While this is important in order to accelerate the pace of transition, there were other aspects that also shone through – including targets for buildings and accelerating permitting processes for renewable energy projects. It is difficult to see how to succeed in increasing the pace without addressing the fact that, in the UK and Spain, it can take 10-12 years of project development to set up offshore and onshore wind projects. Only a fraction of the total time is spent on construction, and as there is a growing need for more energy, the focus is on reducing unnecessary barriers to the green transition.

To quote Alistair Phillips-Davies, the CEO of SSE, "Reforming the planning and permitting processes is critical to the acceleration of renewables deployment globally". (2)

In the US, the role of NEPA (National Environmental Policy Act) has been under more scrutiny, and there is a need to install more capacity while also still protecting the rights of individuals and communities.

With a focus on removing unnecessary obstacles – the pendulum might swing back in favor of renewable projects. New legislation has been tabled in the EU, the US – and is now becoming a focus well beyond these markets in areas such as South Korea and New Zealand (3).

(3) Taking back renewable value chains

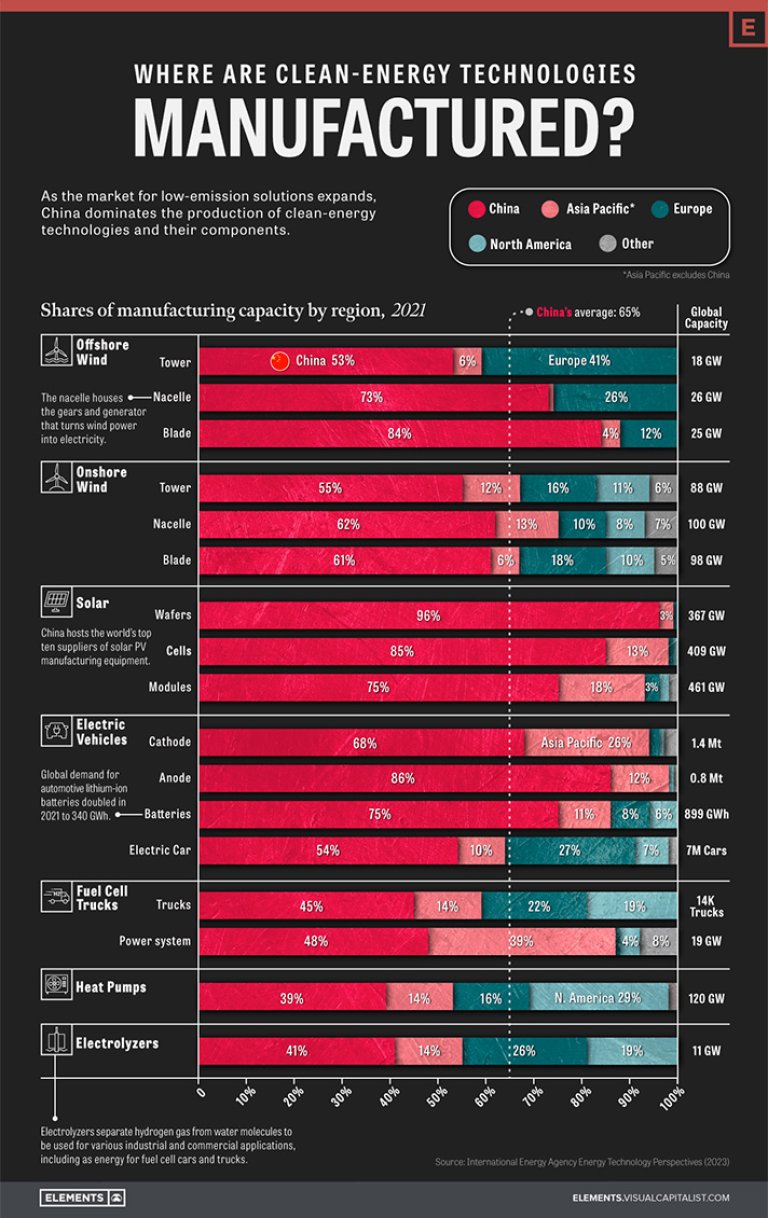

I'll start this point with a Wikipedia entry. "In physics, power is the amount of energy transferred or converted per unit time" (4). I don’t think this description would be very different if we were describing political power. From whaling, to steam technology, to oil and gas, to nuclear and now renewable energy – whoever has it, has power.

China realized this a long time ago.

This is one of the main drivers behind IRA (Inflation Reduction Act) in the US and the response from the European Union. Renewables represents a unique proposition to become independent, at least to a certain degree, from natural resources. However, there is significant control of not only the technology, but the supporting materials that are necessary for production.

In so far as this relates to companies, we can already see how they are incentivized to relocate and reshore, or basically move production to friendly climates. This is affecting the bottom line for companies – and there is now something of an arms race between the USA and EU to be the most attractive market for renewable industries. Such competition might also drive prices up in the short term.

***

Sources:

(1) European Environment Agency

(2) Energy Transitions Commission

(3) Renewables Now and Newshub

(4) Wikipedia

(5) Visual capitalist