We’re pleased to share our latest quarterly sustainable investment review, providing a window into our work during the fourth quarter of 2023, on sustainability, spanning investment, active ownership and exclusion activity.

Significant activity

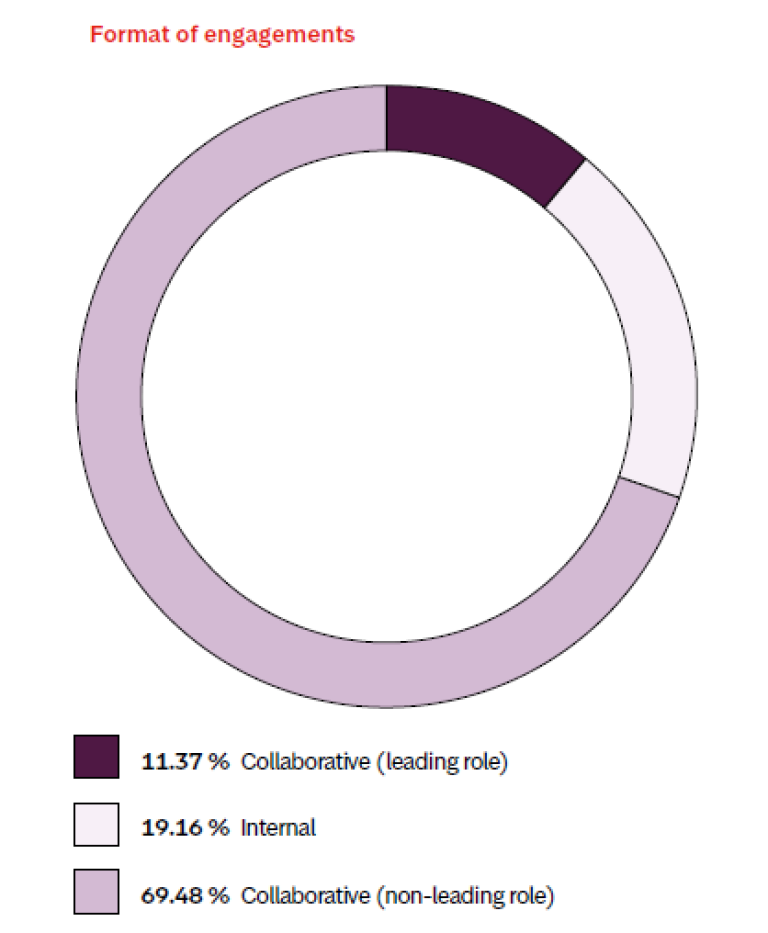

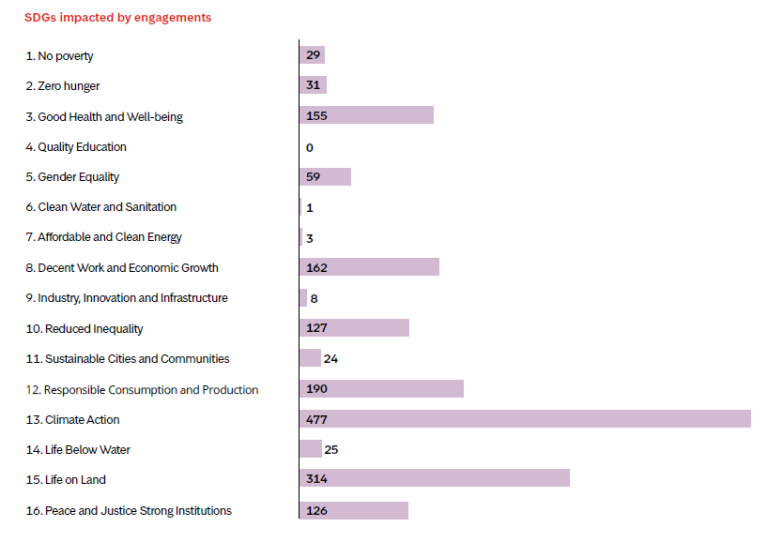

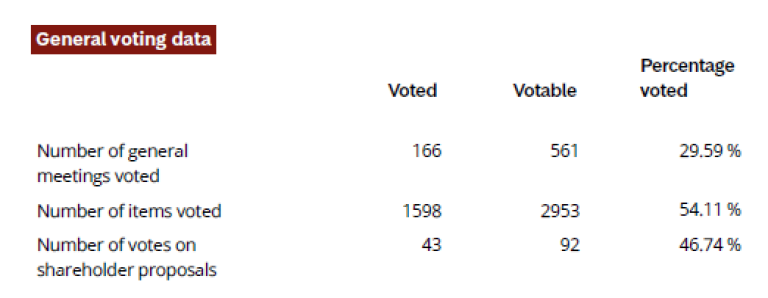

As is often the case, Q4 2023 was a busy one – and that’s reflected in our engagement and voting data for the quarter. We had high levels of engagement activity with companies in our portfolio, continued to be involved in several demanding cases related to voting and shareholder proposals. Collaboration with investors and other stakeholders in society remains a vital theme, and continues to rise steadily as a share of our overall activity.

The quarter was also marked by a significant amount of planned and unplanned engagement activity related to conflict in the Israeli-occupied Palestinian territories (OPT): Gaza where a major war broke out in October, as well as the West Bank which simultaneously experienced a surge in armed conflict. Overall, this is one of the deadliest chapters in a long-running conflict in the OPT, spanning several decades, with no clear resolution in sight. As the most recent outbreak of armed conflict in the OPT flamed up, we were in the middle of our annual screening, engagement and exclusion process for this region. This process, which is detailed in this report, has resulted in an exclusion so far and remains ongoing.

Insights

Alongside the updates and facts on our sustainability activity, we‘ve also assembled a variety of insights and perspectives. Leading things off in this edition, our CEO Jan Erik Saugestad shares his reflections on 2023 and some ideas about what could be ahead for ESG investing in the year ahead. Chief Investment Officer Dagfin Norum also weighs in on Private Equity, the “dark horse of all asset classes”.

Elsewhere in the report, our Head of Human Rights Tulia Machado-Helland highlights what meteoric rise of Artificial Intelligence (AI) will mean for investors from a sustainability risk management point of view, with new regulations coming into play.

In this edition we are also pleased to share valuable insights from two external guest contributors. Martin Norman of the Australasian Centre for Corporate Responsibility (ACCR) offers observations on the way forward for engagement in the active ownership process. And Patrik Witkowsky from the Swedish NGO ChemSec, puts forward his thought son how investors can help society make a better case for eliminating hazardous chemicals.

These and much more insights and data, are available in the