Last year, we wrote an article on how the World Health Organization drastically cut its recommendation for safe air pollution levels. A long year later, the implications are clear: Measures are being taken up by regulators to adhere to the new limits. Could companies gain a competitive advantage if they act ahead of the curve?

Ahead of the COP27 UN Climate Change Conference, the Intergovernmental Panel on Climate Change (IPCC) published several fact sheets on climate research for relevant sectors and regions, based on The Physical Science Basis (Working Group I). (Source: IPCC (2022) In November 2022, the IPCC also published fact sheets related to Impacts, Adaptation and Vulnerability (Working Group II) (Source: IPCC (2022) were also published.

Action on Air Pollution

The Fact Sheet on Health from the physical science perspective draws attention to the link between climate change and health. Interestingly, the fact sheet mentions the air pollution recommendations of the World's Health Organization from last year: “Air pollution dedicated policies will facilitate reaching air quality improvements more rapidly in many regions to reach the World Health Organization guidelines. Additional policies (e.g., access to clean energy, waste management) envisaged to attain Sustainable Development Goals bring complementary air pollution reduction" (Source: Assessment Report, Climate information relevant for Health). The implication for business is clear: regulations to counter air pollution will be made stricter in the years ahead. As a consequence, zero- or low-emission business models and resource efficiency could become drivers of future cash flows?

Investments Wanted

In November, a Fact Sheet on Health was published by Working Group II. This second fact sheet highlights the co-benefits between health and mitigation policies. Quoting from the fact sheet, there are substantial co-benefits from:

🏡 Investing in health systems, infrastructure, water and sanitation, clean energy, affordable healthy diets, low-carbon housing, public transport, improved air quality, and social protection.

🎁 Given the overlap in sources of greenhouse gases and co-pollutants in energy systems, strategies that pursue greenhouse gas emission reductions and improvements in energy efficiency hold significant potential health co-benefits through air pollution emission reductions.

🚅 Urban planning that combines clean, affordable public transportation, shared clean vehicles and accessible active transportation modes can improve air quality and contribute to healthy, equitable societies and higher well-being for all.

🚲 Stimulating active mobility (walking and bicycling) can bring physical and mental health benefits.

🌳 Urban green and blue spaces contribute to climate change adaptation and mitigation and improve physical and mental health and well-being.

Encouragingly, team Solutions works with very similar investment themes when we search for new solution companies – defined as companies with products and services that help achieve the UN Sustainable Development Goals, without causing significant harm to the environment or society. Our sub-themes are structured in categories like renewable energy production, energy storage and distribution, urban planning, low emission mobility and water management, recycling and re-use, sustainable production and access to health services.

Limited Limits

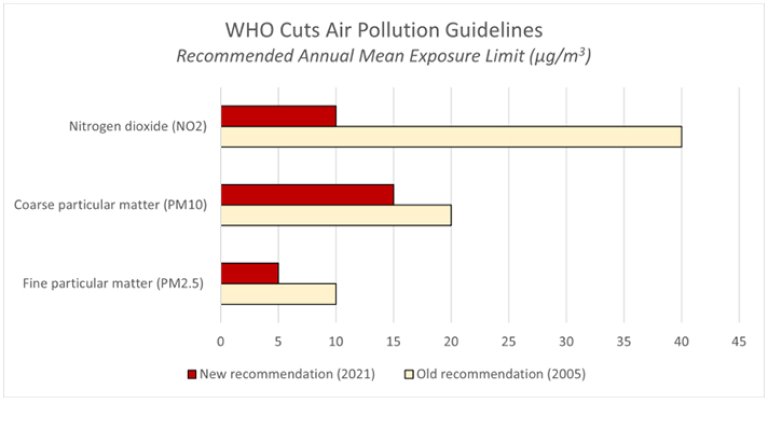

This figure is repeated by popular demand:

Graphic by Storebrand Asset Management based on WHO guidelines.

The chart shows the World Health Organization's recommended threshold for annual mean exposure to the air pollutants nitrogen dioxide (NO2), coarse particulate matter (PM10) and fine particulate matter (PM2.5). The red bars represents the stringent new recommendation from 2021, while the beige bars represent the old 2005 recommendation.

Conclusion: We need a solid blue-sky strategy!