The Japanese government has set a target to reach net zero by 2050, and reduce greenhouse gas emissions (GHG) by 46% compared with 2013 levels. These targets can be ambitious to achieve given the country’s energy history, its reliance on imports, current energy mix and its lack of access to natural resources. [1]

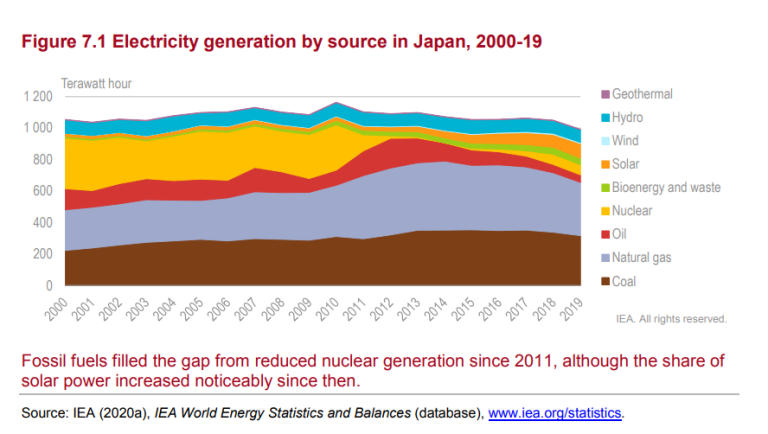

Japan, like many relied on coal until the 1950s/60s and after that became reliant on oil. During the oil crisis in the 1970s the country started investing in nuclear energy and thus became heavily reliant on nuclear energy as an energy source. By 2011 one third of the country’s energy was supplied from nuclear. However, after the Fukushima Daiichi nuclear disaster, when a massive tsunami in 2011 triggered a series of meltdowns at the Fukushima Daiichi Nuclear Power Plant, public sentiment turned strongly against nuclear power and Japan suspended all of the country’s nuclear reactors. Today many of these are still inactive, but Japan is gradually restarting some of these reactors. [2] This is in part due to not wanting to rely solely on energy imports, as the country had a meagre 12.1% primary energy self-sufficiency ratio [3]. It is also in order to meet its commitments to reduce greenhouse gas emissions in line with its Net Zero ambitions. [4]

Source: Japan 2021 - Energy Policy Review (windows.net)

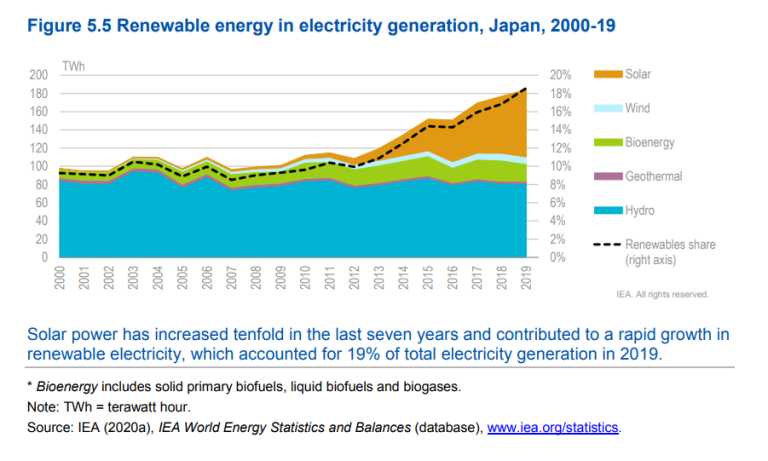

After the Fukushima accident in 2011, Japan’s policies on energy and power mix changed drastically, as the country started to move away from nuclear energy and instead focused on increasing the supply of renewable energy sources to meet its GHG emissions targets. During the period from 2012 to 2019 renewable electricity generation grew by 70% and solar power accounted for 90% of this growth. [5]

Source: Japan 2021 - Energy Policy Review

In October 2023, Storebrand Asset Management met with West Holdings, in Hiroshima, Japan. West Holdings, a solution company providing solar energy solutions, is a portfolio company in Storebrand Renewable Energy and Storebrand Global Solutions. Our delegation, comprised of myself and Storebrand’s senior sustainability analyst Victoria Liden, met with the Chairman, CFO, and Operations & Maintenance Manager of the company in Hiroshima. They showed us several of their solar power plants as well as their control room at their headquarters in Hiroshima.

It was a great opportunity for us to learn more about the company and discuss the outlook for West Holdings and renewable energy in Japan in general. Going forward, the company aims to meet the regulatory changes and navigate the regulatory landscape by focusing on two main areas: construction of low-voltage solar power plants and installing panels for on-site consumption at factories. West Holdings is considered a relatively small company in Japan with around 400 employees, in fact we were the first international investor to visit their headquarters in Hiroshima. Being relatively small, they had the advantage of little to no competition in remote areas in Japan, because they are an established player in the market.

According to some analysts, short-term investments in renewable energy in 2024 are anticipated to decrease due to perceived lack of support for near-term targets. Despite this, Japan is expected to keep its 2030 decarbonisation targets but shift its focus to 2035. [6] As Japan adapts to meet its long-term objectives, the trajectory of its renewable energy sector remains an area we as investors will follow closely in the years ahead. We are positive that there are significant drivers that will push Japan towards meeting its ambition, and that the renewable energy in Japan will grow as a result.

References

[1] Intended Nationally Determined Contributions (INDC): Greenhouse Gas Emission Reduction Target in FY2030 | Ministry of Foreign Affairs of Japan

[2] Japan 2021 - Energy Policy Review

[3] 2021 – Understanding the current energy situation in Japan (Part 1)

[4] Japan 2021 - Energy Policy Review