Solar energy is the most abundant and accessible energy resource on planet earth and vital to transitioning our economic systems. Solar energy works by harnessing the sun’s power to generate electricity. One of the components that can contribute to a more efficient process is a solar tracker. In this blog post, I will go over the benefits of solar trackers and showcase areas for promising growth. But first, let us start with some basics.

Solar photovoltaic (PV) uses electronic devices, also called solar cells, to convert sunlight directly into electricity. The cells are connected to larger power generating units called modules or panels. The modules or panels are only one of many building blocks in a PV system. Several other technologies are needed for the electricity generated by the modules to be suitable for users. These technologies can be grouped into modules, mounting structures, inverters and storage which together form a PV system. In this spotlight we are going to focus on mounting structures and more specifically on utility-scale solar trackers.

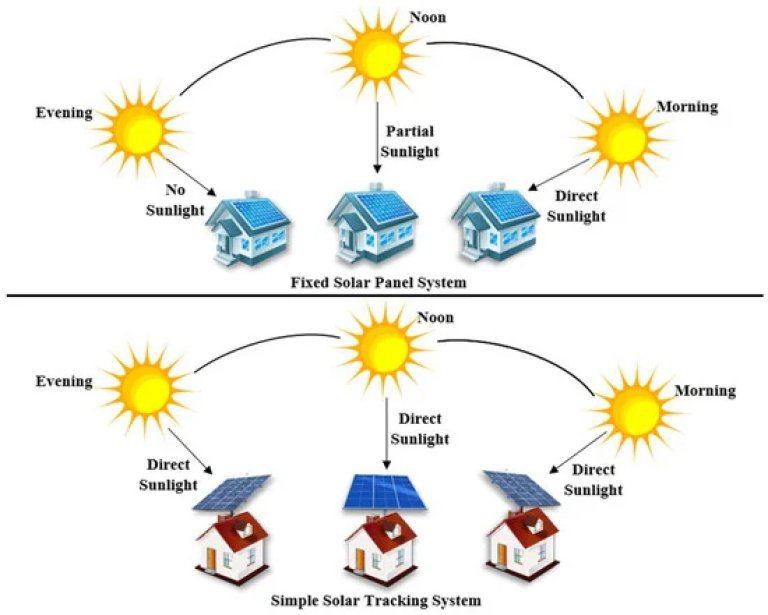

PV mounting systems or a solar racking system are used to fix solar panels to various surfaces such as roofs, building facades or the ground. The orientation of a solar panel is important in order to maximise power output. Mounting systems can be fixed tilt or tracking. Fixed tilt systems are static where the panels are installed at a set angle. Fixed tilt systems have lower maintenance costs but generate less energy (kWh) per unit power (kW) of capacity than tracking systems.

Solar tracking systems change position throughout the day to maximise the angle at which sun rays are received by solar panels. Consequently, they are much more efficient than fixed solar panel systems. The image is representative of the working principle of solar trackers; solar trackers are not usually used on top of residential buildings. Photo: Abdulwaheed Musa and co-authors

The angle at which the sun’s rays meet the surface of the solar panel (known as the “angle of incidence”) determines how well the panel can convert the incoming light into electricity. The narrower the angle of incidence, the more energy a photovoltaic panel can produce. Solar trackers help to minimse this angle by working to orient panels so that light strikes them at an angle as close to 90 degrees as possible. Solar trackers are typically used for ground-mounted solar panels and large, free-standing solar installations like solar trees – they’re not used in most residential solar projects.

Tracking systems can be single-axis or dual-axis. Single-axis trackers rotate around one axis moving from east to west tracking the sun. Dual-axis trackers rotate around two axes, east to west but also north to south, maximising power output throughout the year tracking seasonal variations in the height of the sun in addition to normal daily movements. According to National Renewable Energy Laboratory (NREL) single-axis trackers can increase energy output 25% or more with dual-axis tracking, potentially increasing output up to 35% or more. Consequently, the increased energy output comes with increased maintenance and equipment costs.

In the US single-axis tracking has exceeded fixed-tilt installations since 2015 and in 2021 90% of all new capacity added used tracking. Tracking systems have historically been more expensive. However as shown in a sample of projects in the US presented by Lawrence Berkeley National Laboratory the price difference has diminished over time. In the sample tracking systems continued to exhibit some premium over fixed-tilt plants in 2020. Still, as mentioned in the report, trackers can sustain some amount of higher upfront costs as they deliver more kwh per kW.

Market potential for solar trackers

Most of the market uses single axis horizontal trackers and dual axis trackers. According to BNEF data on PV tracker shipments, in 2020 thirteen suppliers accounted for 89% of the market. Two suppliers that stood out were Nextracker Inc and Array Technologies with 27% and 18% of the shipments respectively. The same data showed that US was by far the biggest market for trackers (49%) followed by China (15%). As stated in the report, in general, the tracking systems are more useful in sunny countries and are seldom deployed in northern European markets or even most of China because the capacity factor increase does not justify the cost increase. Tracking systems also use more land than fixed-axis systems, which makes up another reason preventing their mass scale deployment. (BloombergNEF, 2021/06/10, "Booming Solar Tracker Market Innovates to Watch the Wind")

All factors considered, we believe that the development and the attractive economics in single-axis tracking technologies makes it an interesting area of investment. Although not suitable for all areas, we still believe that there is room for the tracking market to grow going forward. Through our funds Storebrand Global Solutions and Storebrand Renewable Energy, we have taken a position in two companies within the space, namely Nextracker Inc and Array Technologies. The two companies are primary competitors in the tracking space, and both offer compelling products and have different value propositions. In this phase of the market, we still see ample room for both companies to grow.