What is the fund’s objective and who is it suitable for?

The fund is part of our passive range which aims to provide index-near returns at low cost but with enhanced sustainability characteristics versus the markets they track. These funds are popular amongst institutional and private clients seeking index-like returns but with improved ESG characteristics by avoiding exposure to certain types of companies.

Storebrand Global Index tracks the MSCI World Index but applies Storebrand’s exclusion list which removes companies from the investment universe based on their unsustainable conduct, products or business practices. Once these stocks are excluded, we then optimise the portfolio to replicate the return-profile of the index as closely as possible by minimising tracking error.

When did the fund launch and how has it performed?

The fund was launched in December 2005, and I took over running the portfolio in 2017. It has steadily grown over its 20-year history and now has nearly €4 billion AUM, mainly from Nordic clients but increasingly from investors across mainland Europe – the fund received marketing permission in France in May 2025.

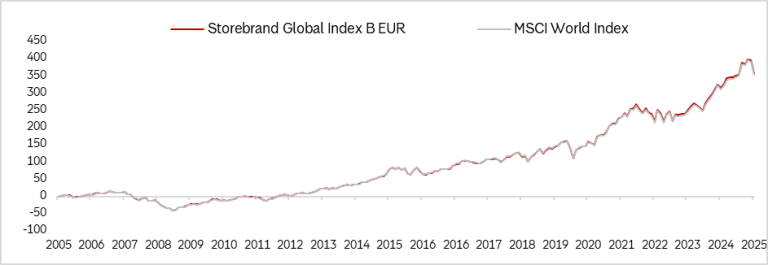

The fund has successfully delivered on its investment objective, generating returns broadly in line with the MSCI World Index over different time periods (e.g. 1, 3, 5, 10 years and since inception) with low tracking error (0.3% over 1 and 3 years).

What are the fund’s sustainability credentials?

Storebrand Global Index is classified as Article 8 under SFDR, meaning that it is considered to promote environmental or social characteristics. The fund has 3 globes based on the Morningstar Sustainability Rating. It also has marginally higher exposure to green investments than the benchmark, with 2.0% of assets invested in companies classified as such by the Climate Investment Coalition (CIC) versus 1.8% for the MSCI World Index.

On internal metrics, the fund measures 7/10 using Storebrand’s sustainability score, versus 5/10 for the MSCI World Index. This assesses sustainability-related risks and opportunities, based on the underlying portfolio companies. It also scores 84 for carbon intensity, versus 108 for the benchmark. This measures emissions in tonnes of CO2 relative to earnings, with a lower score reflecting lower carbon intensity.

Can you explain the fund’s investment process?

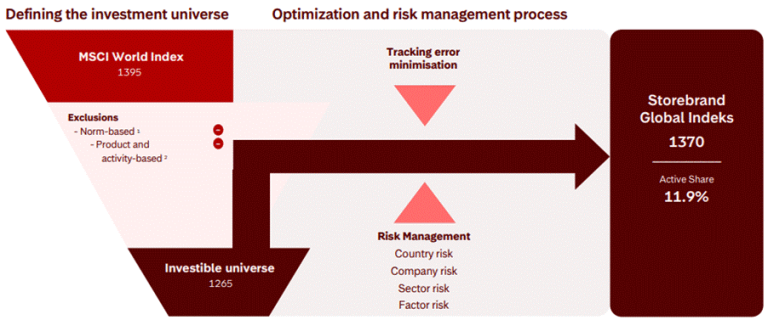

In simple terms, the fund follows a two-step process. First, we apply Storebrand’s exclusion screen which removes around 130 of the 1,395 companies in the MSCI World Index investment universe. Second, we then use MSCI Barra to minimise tracking error. In practical terms this means that we adjust the weightings of the remaining stocks to replicate the benchmark return as closely as possible within the constraints imposed by the exclusion screen in step one.

The investment process can be illustrated as follows:

How does the Storebrand exclusion policy work?

Storebrand’s exclusion list applies firm-wide and is updated quarterly. It is also very extensive (currently over 300 companies globally are excluded from our investment universe), using both internal and external data as well as evaluations conducted by field experts. Exclusions are either norm-based or product and activity-based:

- Norm-based: Companies in breach of human rights, labour and international laws, involved in corruption and financial crime, or serious environmental and climate damage. State-owned and controlled companies in countries lacking elementary institutions to prevent corruption, fulfil basic social and political rights, and contribute to maintaining international peace and security are also excluded as well as those involved in controversial weapons.

- Product and activity-based: Tobacco, recreational cannabis, oil sand, arctic drilling, deep-sea mining, marine tailing disposal, coal-related activities, lobbying against the goals of the Paris Agreement and Global Biodiversity Framework, operations in biodiversity–sensitive areas, companies that are involved in deforestation or conversion of native ecosystems through severe and/or systematic unsustainable production of palm oil, soy, cattle, timber, cocoa, coffee, rubber and minerals.

The fund applies the Storebrand exclusion list as part of its investment process so companies we consider unsustainable are excluded from our investment universe. More information, including the full list of excluded companies, is available on our website.

What is the MSCI Barra tool and how does it optimise the portfolio?

The MSCI Barra risk model ensures that the portfolio has the required sustainability characteristics with as low tracking error as possible by targeting the same factor exposures as the benchmark. I was actually part of the team responsible for maintaining and developing Barra factor models in a previous role at MSCI and we use it across all of Storebrand’s index-tracking, optimised and factor strategies which have combined AUM of around $45 billion.

The tool works to replicate the performance of excluded stocks by using a basket of alternatives that have similar risk-return profiles in order to minimise the portfolio tracking error. For example, tobacco companies such as British American Tobacco and Philip Morris International are excluded and replaced by a basket of consumer staples stocks with similar characteristics, such as Pepsico, Brown-Forman, Monster Bev, Unilever and Molson Coors Beverage which are then typically overweight positions in the fund versus the benchmark.

What do you see as the fund’s three main selling points?

There are lots but here are my top three! First, the fund has an established 20-year track-record of delivering index-near returns with low tracking error over different time periods – the performance chart below since inception illustrates how closely the fund has followed the benchmark.

Second, the fund has a higher degree of sustainability than the MSCI World Index it tracks. As well as Storebrand’s strict exclusion list, clients benefit from our company engagement activities. Our sustainable investment team is in dialogue with a large number of companies each year, seeking to influence them to move in a more sustainable direction for the benefit of shareholders and other stakeholders.

Third, it provides this in a fully transparent and low-cost strategy with management fees starting from as low as 0.09% for some share classes. I believe that these three points should be appealing to investors.